- Log in to post comments

ARMONK, N.Y. - 14 Jan 2011: More than half of midsize companies are planning to increase their information technology (IT) budgets over the next 12 to 18 months, according to an IBM global study of more than 2,000 midsize companies representing more than 20 countries. As a result, these companies are investing in a wide range of priorities including analytics, cloud computing, collaboration, mobility and customer relationship solutions.

"Inside the Midmarket: A 2011 Perspective," commissioned by IBM (NYSE: IBM) and conducted independently by KS&R, Inc., found 70% of midsize companies are actively pursuing analytics technology to better understand their customers, make better decisions and become more efficient. The study also shows growing adoption of cloud computing among midsize firms, with two-thirds either planning or currently deploying cloud-based technologies to improve IT systems management while lowering costs.

- 53% of respondents expect their IT budgets to increase over the next 12 to 18 months, 31% expect they will remain unchanged and 16% think they will decrease or are unsure.

- Security (63%), customer relationship management (62%) and analytics / information management (59%) were cited as their "Most Critical IT Priorities."

- 75% plan to upgrade their core IT systems to improve performance, security and reliability.

- Top expected benefits from cloud computing include cost reduction, better manageability of IT, improved system redundancy and availability.

- To achieve their technology objectives, more than 70% plan to pursue a consultative (IT and business), versus purely transactional relationship with their primary IT provider.

- Top barriers to IT adoption cited were cost, difficulty in acquiring and deploying technology solutions, and lack of IT skills and resources.

"The survey findings show that midsize firms are tackling a new set of opportunities to advance their role as engines of economic growth," said Andy Monshaw, General Manager, IBM Midmarket. "When we spoke to midsize firms 18 months ago, most were focused on reducing costs and improving efficiencies. Today, the conversation is also about expanding their business, connecting with customers and gaining greater insights."

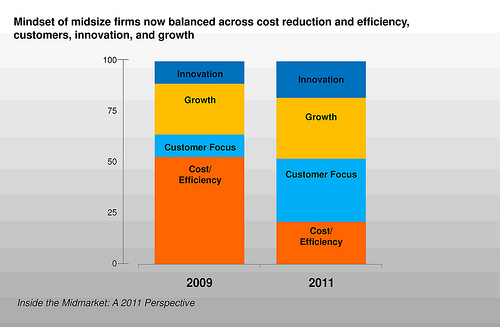

Comparisons between the current study and those from 2009 also reveal a shift from a predominant focus on cost control and efficiency to a greater emphasis on growth initiatives. Today, 21% characterize their strategic mindset as 'efficiency and cost control', with the majority (79%) concentrating on customers, growth and innovation. In 2009, 53% characterized their company mindset as one of efficiency and cost control", with less than half (47%) focused on growth, innovation and customers. This change is reflected in the increased adoption of analytics and predictive technologies that have become more affordable and widely available for midsize companies.

IBM - Mindset of Midsize firms The mindset of midsize firms is now balanced across cost reduction and efficiency, customers, innovation, and growth.

"We've seen a boom in the number of midsize customers within the consumer products space who want to engage with us around analytics and cloud," said Jay Hakami, President and CEO of Sky IT Group, an IBM Business Partner. "IT departments in midsize markets are adapting very fast to that fact that they must do much more with less. Companies are looking to quickly identify tools and efficient ways to support growth and innovation."

About the Study

"Inside the Midmarket: A 2011 Perspective" was commissioned by IBM and conducted independently by KS&R, Inc. The survey of 2,112 business and information technology decision makers at midsize businesses (100-1000 employees) spanned a variety of industries, including banking, retail, consumer products, wholesale, transportation, industrial products, and insurance. Participants hailed from the United States, Canada, the United Kingdom, the Nordics (Denmark, Finland, Norway, Sweden), Germany, France, Italy, Belgium, Luxembourg, Netherlands, Spain, Japan, China, Brazil, India, Russia, Australia, Mexico, Korea, Singapore, South Africa, Poland, New Zealand and the Czech Republic. The study was conducted in the fourth quarter of 2010 to capture current and upcoming business and IT priorities and investment direction.

Download the report for more information